Our dedication to Racial Equality and Social Justice (RESJ) spans decades. Learn more about our RESJ Initiative

Loans

Financial aid awards are posted to student accounts beginning on the Monday after the Add/Drop deadline. Loan agency funding may take up to 10-14 business days from their disbursement date before the college receives your funds. The college receives/posts federal funding on Mondays. From the date it is posted to your account Cambridge College has 14 business days to refund any eligible excess funds.

Federal Student Loans

Federal Direct Loan

Information published by the Department of Education about rights and responsibilities of students and institutions under Title IV, HEA loan programs may be accessed at: www.studentaid.gov.

William D. Ford Federal Direct Loan:

Undergraduate

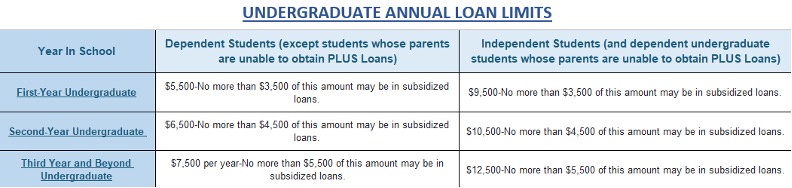

The Federal Direct Loan program, formerly called the Federal Stafford Loan, provides low-interest loan funds for students. There are two types of Federal Direct Loans: subsidized and unsubsidized. Both versions accrue interest while you are enrolled. For subsidized loans, the interest is paid by the federal government until you are no longer enrolled at least half time. With the unsubsidized version, the interest accrued is your responsibility. You have the option of either paying the interest while you are enrolled or deferring it. If you choose deferment, the interest is capitalized (added to the principal) when repayment begins.

For direct Subsidized and Unsubsidized loans disbursed on or after July 1, 2022, and before July 1, 2023, there will be a fixed interest rate of 4.99% after the payment pause ends. If your loan was disbursed before July 1, 2022, it likely has a different interest rate. View interest rates for loans disbursed earlier. This interest rate will be in effect for the life of the loan. The federal government limits the amount you can borrow each academic year.

Repayment begins six months after you graduate or drop below half-time enrollment. There is an origination fee (currently 1.057%) deducted from the loan prior to disbursement. This means the amount of the loan included on your award letter represents the gross amount, and you will actually receive 98.943% of that total.

If you have sufficient financial need, we have offered you a subsidized Direct Loan. If you do not have financial need, or your need is met by other sources, we have offered you an unsubsidized Direct Loan only. All students, regardless of need and grade level, are eligible for an additional $2,000 unsubsidized Direct Loan which is likely included in your award. Please think carefully before accepting the unsubsidized Direct Loan, since the cost of borrowing this loan is more expensive overall due to the lack of a subsidy.

Graduate

The Federal Unsubsidized Direct Loan Program

The Federal Unsubsidized Direct Loan program, formerly called the Stafford loan program, provides funds for students through the federal government. You may borrow up to $20,500 each academic year. The interest rates for Direct Unsubsidized loans disbursed on or after July 1, 2022 and before July 1, 2023 is 6.54%. If your loan was disbursed before July 1, 2022, you likely have a different interest rate. Click Here to View interest rates for loans disbursed earlier. All Federal Unsubsidized Direct Loans disbursed after October 1, 2020 and prior to October 1, 2023 have a 1.057% origination fee.

Under the Federal Unsubsidized Direct Loan program, no payment is required while you are enrolled on a half-time basis (minimum of 4.0 credits per semester) and during a six-month grace period. The interest, however, will accrue and is your responsibility. The interest may be paid during school or deferred then capitalized (added to the principal) when repayment begins.

Unless you reject this loan, Cambridge College will automatically process your Federal Unsubsidized Direct Loan electronically through the federal government. We will process a loan for the amount shown on your award notification unless you decline or reduce the amount by returning the notification to us with your instructions.

IMPORTANT: You are now able to complete a single master promissory note (MPN) that will be used for as long as you attend Cambridge College. Detailed instructions on how to e-sign your MPN will be sent to you after we process your loan.

Federal Unsubsidized Direct Loan applicants borrowing for the first time are required to complete loan counseling to learn about their rights and responsibilities as borrowers. This counseling can be completed at the studentaid.gov website. No loan funds will be disbursed until this requirement is met. Failure to complete loan counseling may result in the cancellation of your loan.

- William D. Ford Federal Direct Loans are available to students who are enrolled at least half time.

- Direct PLUS Loans for graduate and professional degree students and for parents of dependent undergraduate students.

- Direct Consolidation Loans to combine federal education loan debts into a single loan.

Alternative Loan Programs

- To apply for alternative loans please go to: www.elmselect.com